A Financial Application For Loan Management And Investment

Finratus promotes easy integration to minimize the costs associated with managing multiple systems. It richly covers the full cycle from; origination, underwriting, collection tracking, loan servicing and portfolio reporting – our solutions make lending and savings easier by improving customer onboarding, increasing transparency and streamlining back-office operations.

Industries Fin'Ratus Serve

Finratus has been designed to manage the complete loan lifecycle of every Non-Banking Financial Companies. It enables consumers to implement peculiar products within minutes and automate their business processes hence improving the overall operational efficiency.

- Loan Application Management

- Collection Management

- Workflow Management

- Document Management

Our Finance and Lending software is a full-bodied and scalable platform that helps to automate all business processes of your organization on a centralized technology backbone, thereby helping you to plan your business growth at reduced cost and keep track of the profitability as well as compliance & reporting.

- Savings

- Investment

- Loan Management

- Collection Management

Our Lending and Micro Finance Banking software is built on advanced web technologies. Easy integration with existing and future systems of financial institution is enabled due to its cutting-edge technological qualities and its independence nature. It significantly helps automate front-end and back-end processes to achieve centralized and smooth processing.

- Client Web Portal

- Client Mobile Banking

- Workflow Management

- Savings

- Investment

Some Other Features Of Fin'Ratus

- Workflow Management

- Track the progress of targets

- Automatic/Manually approved loans

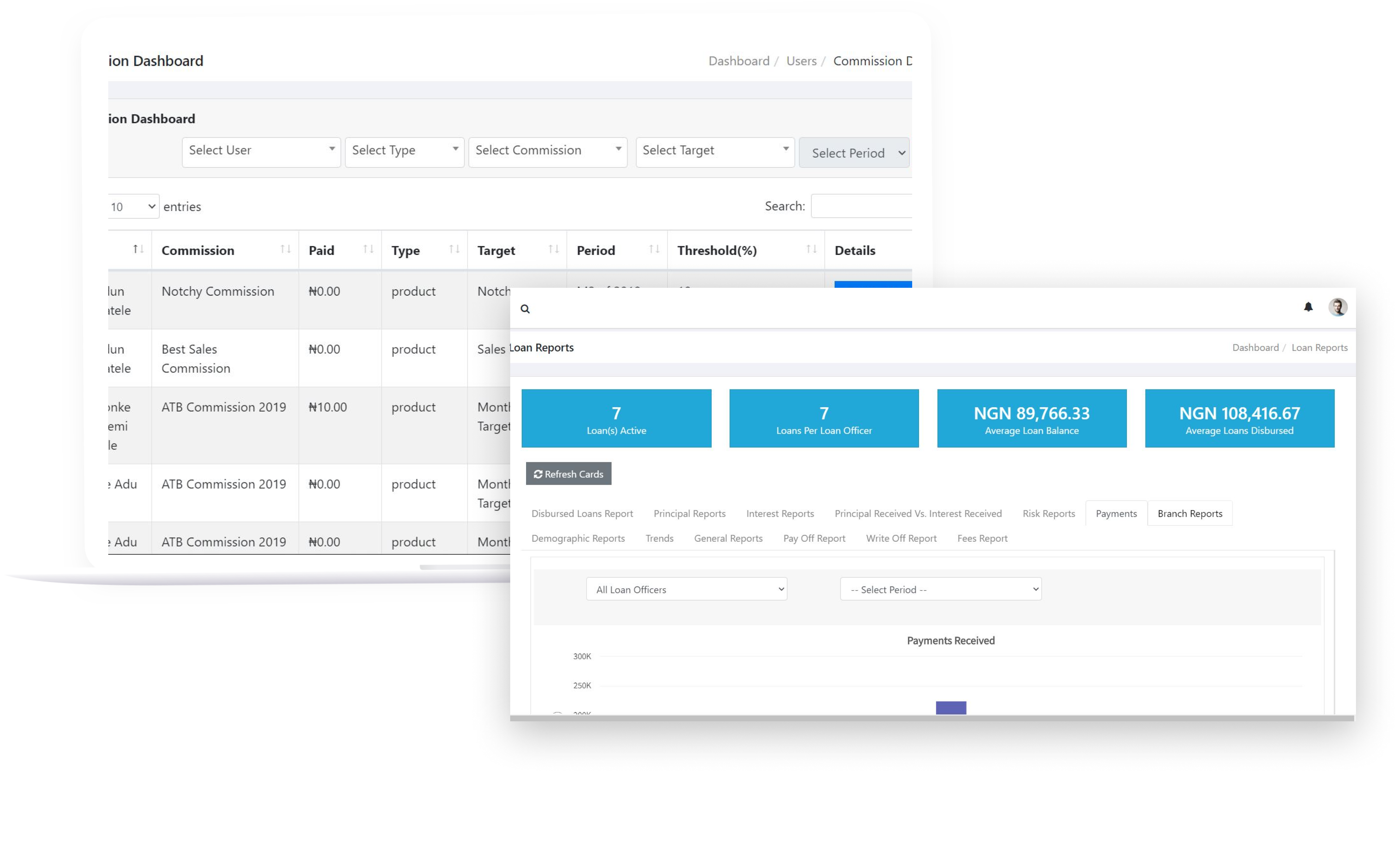

- Create different commission profiles and associate with salespeople

- Set up commission accelerators

- Create multiple commission profile

- Assign monthly, quarterly, half-yearly and annual target to salespeople

- Assign Company targets, individual and team targets

- Track the progress of targets

- Interest report

- Risk report

- Trend report

- Branch report

- Create client

- Manage different types of client (Corporate, Individual)

- Bulk creation of client

View and manage Salespersons' day-to-day engagements with clients .